What is VITA?

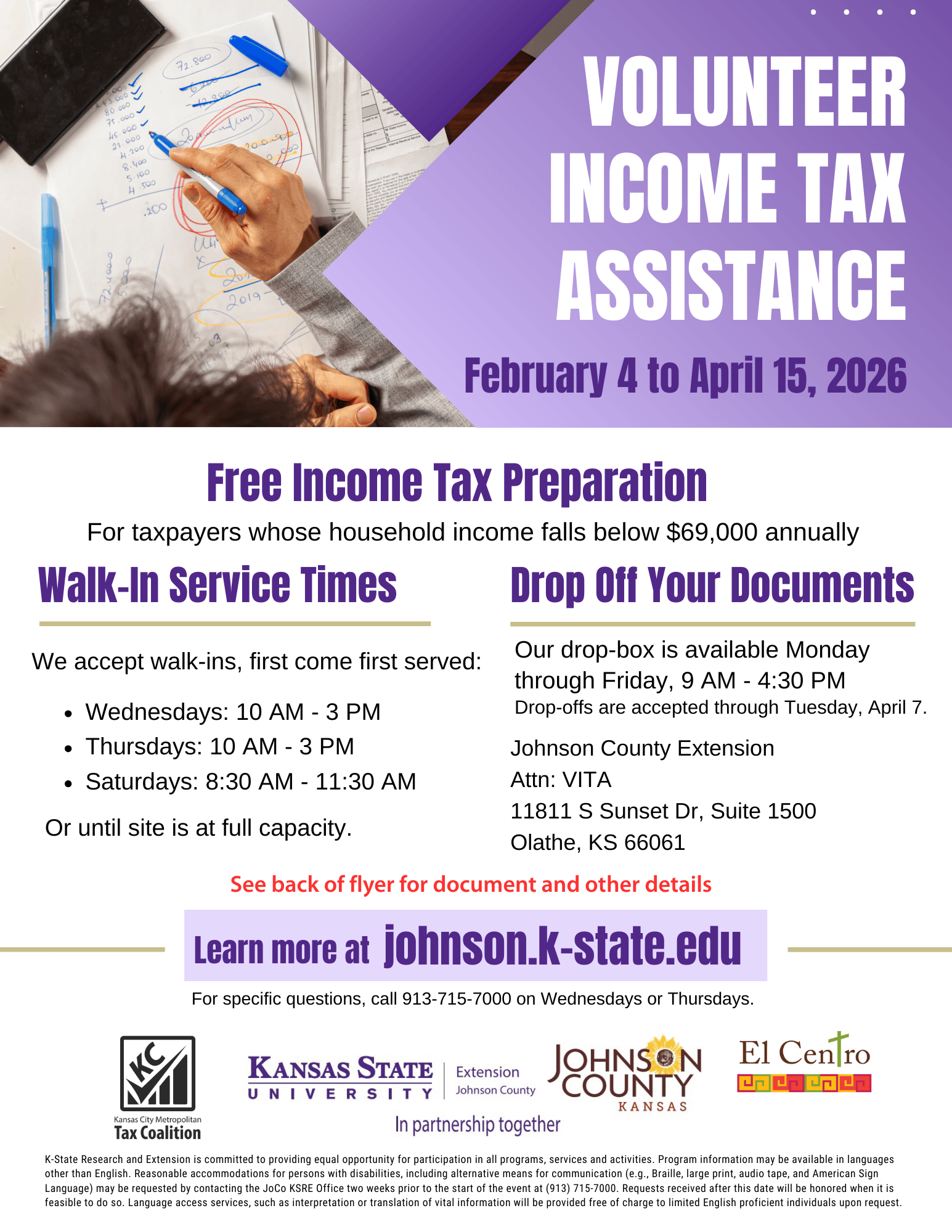

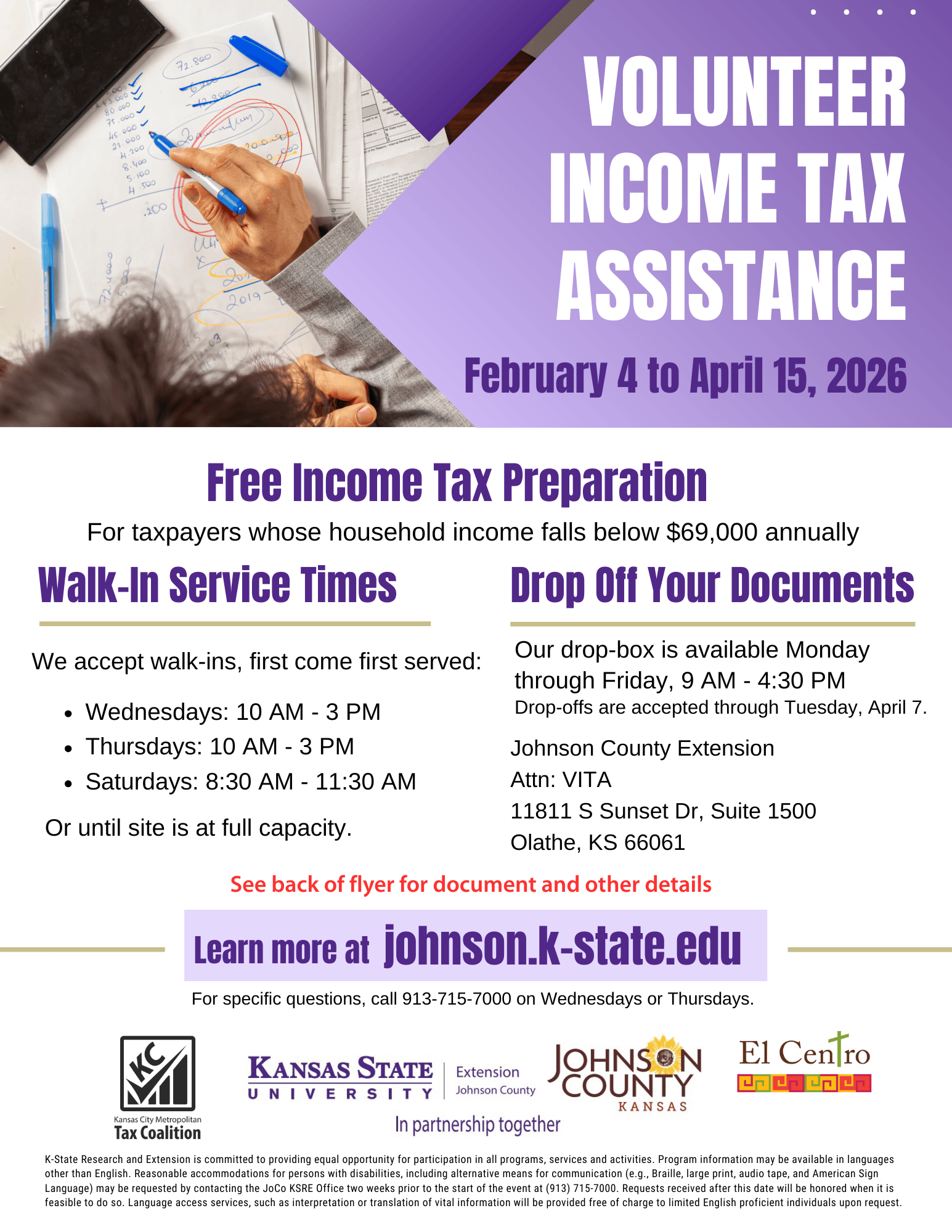

The Volunteer Income Tax Assistance program has operated for over 50 years. VITA sites offer free tax preparation and e-filing for qualifying households for taxpayers whose household income falls below $69,000 or less.

While the IRS manages the VITA program, the VITA sites are operated by IRS partners and staffed by volunteers.

All VITA volunteers must take and pass tax law training that meets or exceeds IRS standards. This training includes maintaining the privacy and confidentiality of all taxpayer information. In addition to requiring volunteers to certify their knowledge of the tax laws, the IRS requires a quality review check for every return prepared at a VITA site prior to filing.

**please note: our volunteers are tax PREPARERS, not tax ADVISORS. We are unable to offer tax advice.

If you do not qualify for VITA and don't want to do-it-yourself, follow these guidelines before hiring a tax professional.