Finding Your Own Pot of Gold: A Practical Guide to Financial Checkups

Start With a Financial Fitness Quiz

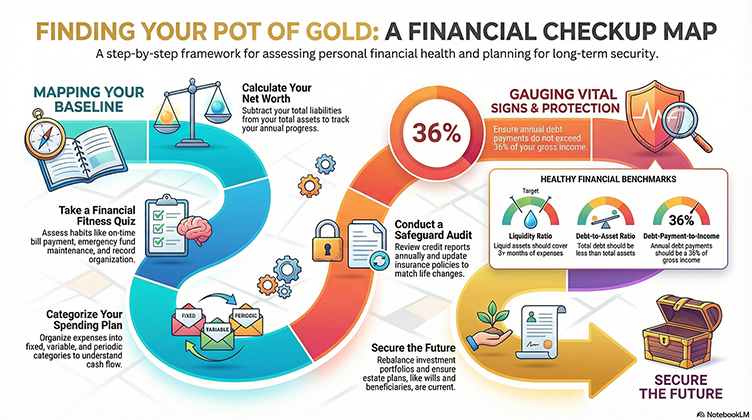

A helpful first step is to assess your current financial habits across areas such as budgeting, saving, credit use, insurance, and shopping behaviors. The How Are You Doing? A Financial Checkup quiz can highlight strengths and pinpoint areas needing attention. Consistently paying bills on time, maintaining an emergency fund, and keeping organized financial records are signs of strong financial management. Lower scores in areas like credit card repayment or savings can reveal opportunities for improvement.

Understand Your Net Worth

A key part of any financial checkup is calculating your net worth—your total assets minus your total liabilities. Tracking this number annually helps you see whether you’re moving forward. Ideally, your net worth should increase each year as you save more and reduce debt. This snapshot is also useful for estate planning and preparing for major financial decisions.

Review Income, Expenses, and Ratios

A spending plan, or budget, shows where your money goes and how much is available for saving or debt reduction. Categorizing expenses as fixed, variable, or periodic can help you better understand your cash flow.

Financial ratios offer another lens for evaluating your situation:

- Liquidity ratio: Liquid assets should cover at least three months of expenses.

- Debt‑to‑asset ratio: Total debt should be less than total assets.

- Debt‑payment‑to‑income ratio: Annual debt payments should not exceed 36% of gross income.

Conduct Credit and Insurance Checkups

Your credit health affects everything from loan approvals to insurance rates. Reviewing your credit report annually, paying down balances, and negotiating lower interest rates when possible can strengthen your financial standing.

Insurance is another essential safeguard. Reviewing your homeowners, auto, disability, life, and health insurance policies ensures you have adequate coverage and that your protection keeps pace with life changes.

Plan for Retirement and Beyond

A thorough checkup includes reviewing Social Security benefits, employer retirement plans, and personal investments. Understanding your risk tolerance, rebalancing your portfolio, and estimating future income needs help ensure long‑term security. Estate planning—wills, powers of attorney, and beneficiary designations—rounds out a complete financial health strategy.

A financial checkup isn’t a one‑time task—it’s a habit that builds resilience and confidence. By taking time each year to assess your financial picture, you give yourself the tools to make informed decisions and move steadily toward your goals—no luck required.

By Joy Miller, Family and Community Wellness Agent, 2026