Free Tax Preparation:

Volunteer Income Tax Assistance (VITA)

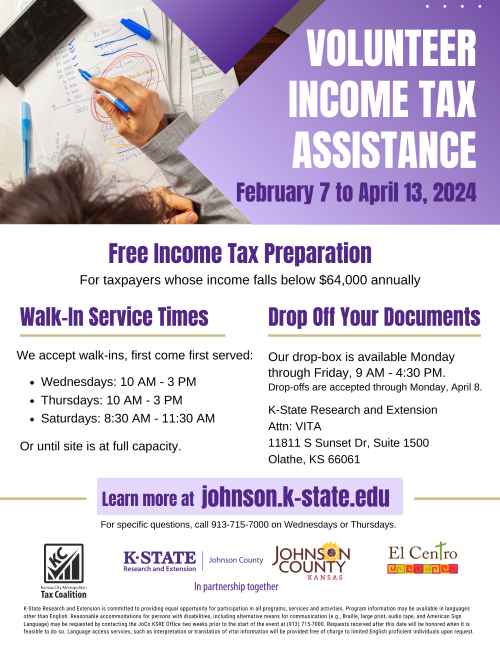

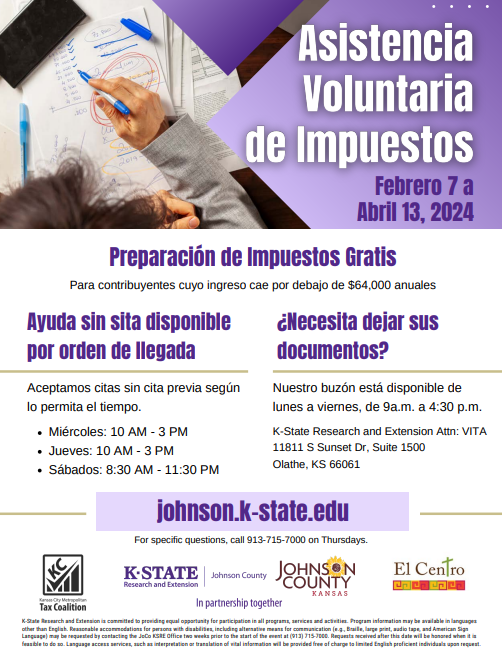

The IRS's Volunteer Income Tax Assistance (VITA) program offers free basic tax return preparation to qualified individuals who make $64,000 a year or less.

February 7 to April 13, 2024

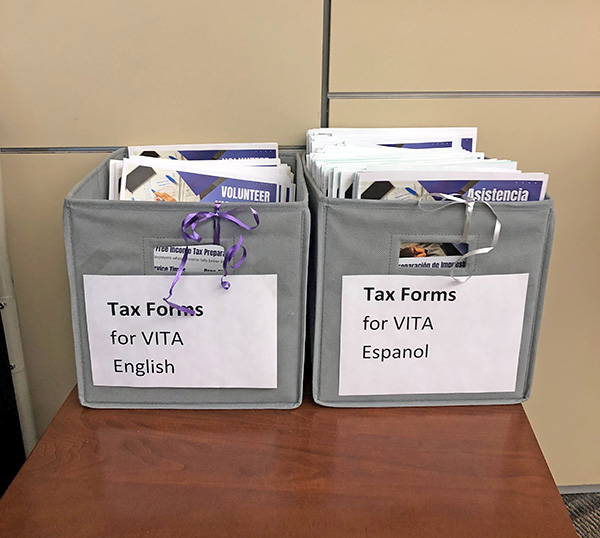

Updated tax forms and packets for the 2023 tax year are now available to pick up in the Extension Office.

Two service types:

Walk-In Assistance | Drop-Off Assistance |

| In-person service; taxes prepared while you wait | Drop off your documents. A tax reviewer will prepare your taxes and call you to complete the process |

| Intake forms completed in person | Copies and intake forms are dropped off in advance |

| E-file completed that day | E-file completed after phone consultation |

Informational Flyers

| 2024 VITA-English-language version | 2024 VITA Spanish-language version |

|  |

Walk-In Service

There are no appointments. First come first serve.

We serve walk-ins during the following times:

- Wednesdays: Check-in between 10 AM and 3 PM

- Thursdays: Check-in between 10 AM and 3 PM

- Saturdays: Check-in between 8:30 AM and 11:30 AM

Or until site is at full capacity.

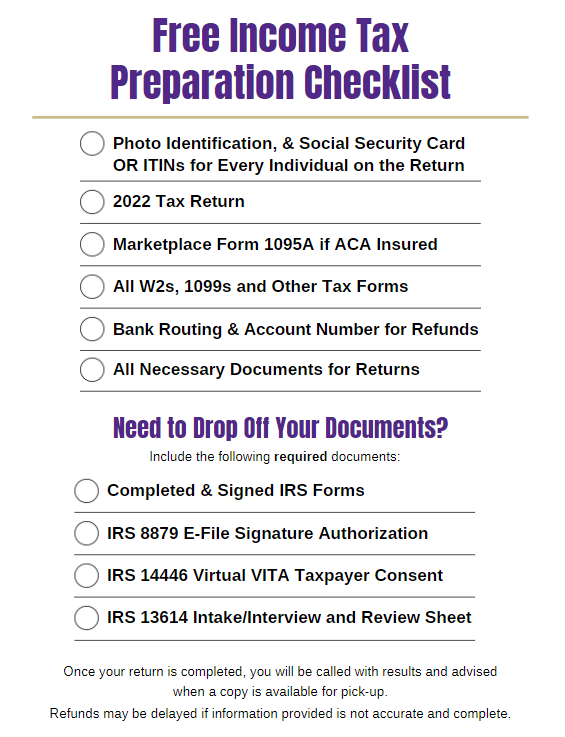

List of items to bring:

- Photo Identification, & Social Security Card or ITINs for Every Individual on the Return

- 2022 Tax Return

- Marketplace Form 1095A if ACA Insured

- All W2s, 1099s and Other Tax Forms

- Bank Routing & Account Number for Refunds

- All Necessary Documents for Returns

Click here for a checklist of items to bring with you.

Drop-Off Service

A secure drop box is available Monday through Friday, 9 AM to 4:30 PM.

Drop offs will be accepted through April 8, 2024. Please allow adequate time for the mail to reach us before the deadline. Be prepared to pick up any dropped off or mailed-in paperwork upon notification that your taxes are completed.

K-State Research and Extension

K-State Research and Extension

Attn: VITA

11811 S. Sunset Drive, Suite 1500

Olathe, KS 66061

Required Tax Fillable Documents

Copies To Submit:

- Proof of identification (photo ID)

- Social Security cards or ITINS for you, your spouse and everyone else on the tax return.

- Wage and earning statements (Form W-2, W-2G, 1099-R,1099-Misc) from all employers

- Interest and dividend statements from banks (Forms 1099)

- A copy of last year’s federal and state returns, if available

- Proof of bank account routing and account numbers for direct deposit such as a voided check

- Total paid for daycare provider and the daycare provider's tax identifying number such as their Social Security number or business Employer Identification Number

- Health Insurance Exemption Certificate, if received

- Forms 1095-A, B and C, Health Coverage Statements

- Copies of income transcripts from IRS and state, if applicable

What is VITA?

The VITA program has operated for over 50 years. VITA sites offer free tax help to people who need assistance in preparing their own tax returns, including:

- People who generally make $64,000 or less

- Persons with disabilities; and

- Limited English-speaking taxpayers

While the IRS manages the VITA program, the VITA sites are operated by IRS partners and staffed by volunteers who want to make a difference in their communities. The IRS-certified volunteers who provide tax counseling are often retired individuals associated with non-profit organizations that receive grants from the IRS.

VITA services are not only free, they are also a reliable and trusted source for preparing tax returns. All VITA volunteers who prepare returns must take and pass tax law training that meets or exceeds IRS standards. This training includes maintaining the privacy and confidentiality of all taxpayer information. In addition to requiring volunteers to certify their knowledge of the tax laws, the IRS requires a quality review check for every return prepared at a VITA site prior to filing. Each filing season, tens of thousands of dedicated VITA volunteers prepare millions of federal and state returns. They also assist taxpayers with the preparation of thousands of Facilitated Self-Assistance returns.

Partnership

This VITA site is a partnership between Johnson County K-State Research and Extension, El Centro, Inc., and Kansas City Metropolitan Tax Coalition. In addition, VITA is powered by volunteers! Learn more

Choosing an Income Tax Preparer

If you do not qualify for VITA and don't want to do-it-yourself, follow these guidelines before hiring a tax professional.

Questions?

If you need tax returns completed during the off season, please call 2-1-1 and United Way will connect you with volunteers to complete and file income taxes.

For specific questions about this VITA site, call us on Wednesdays or Thursdays at 913-715-7000.